Long Call Calendar Spread

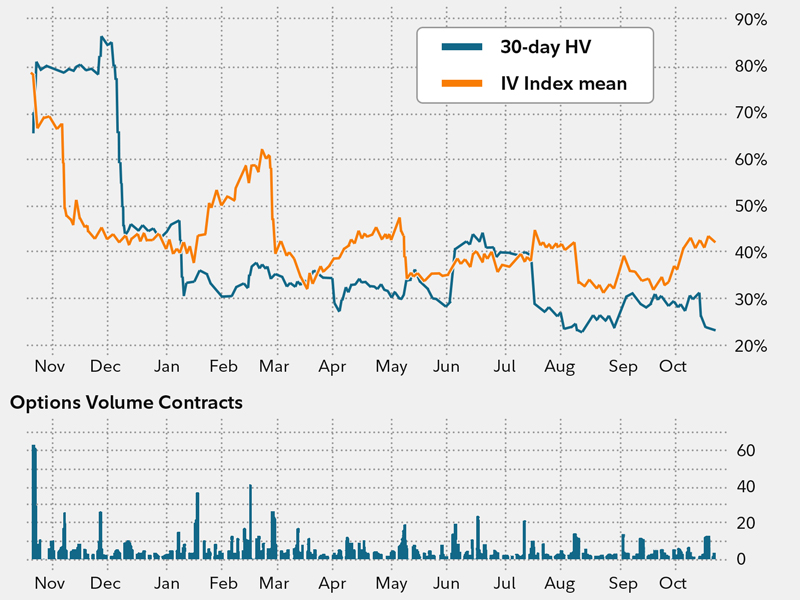

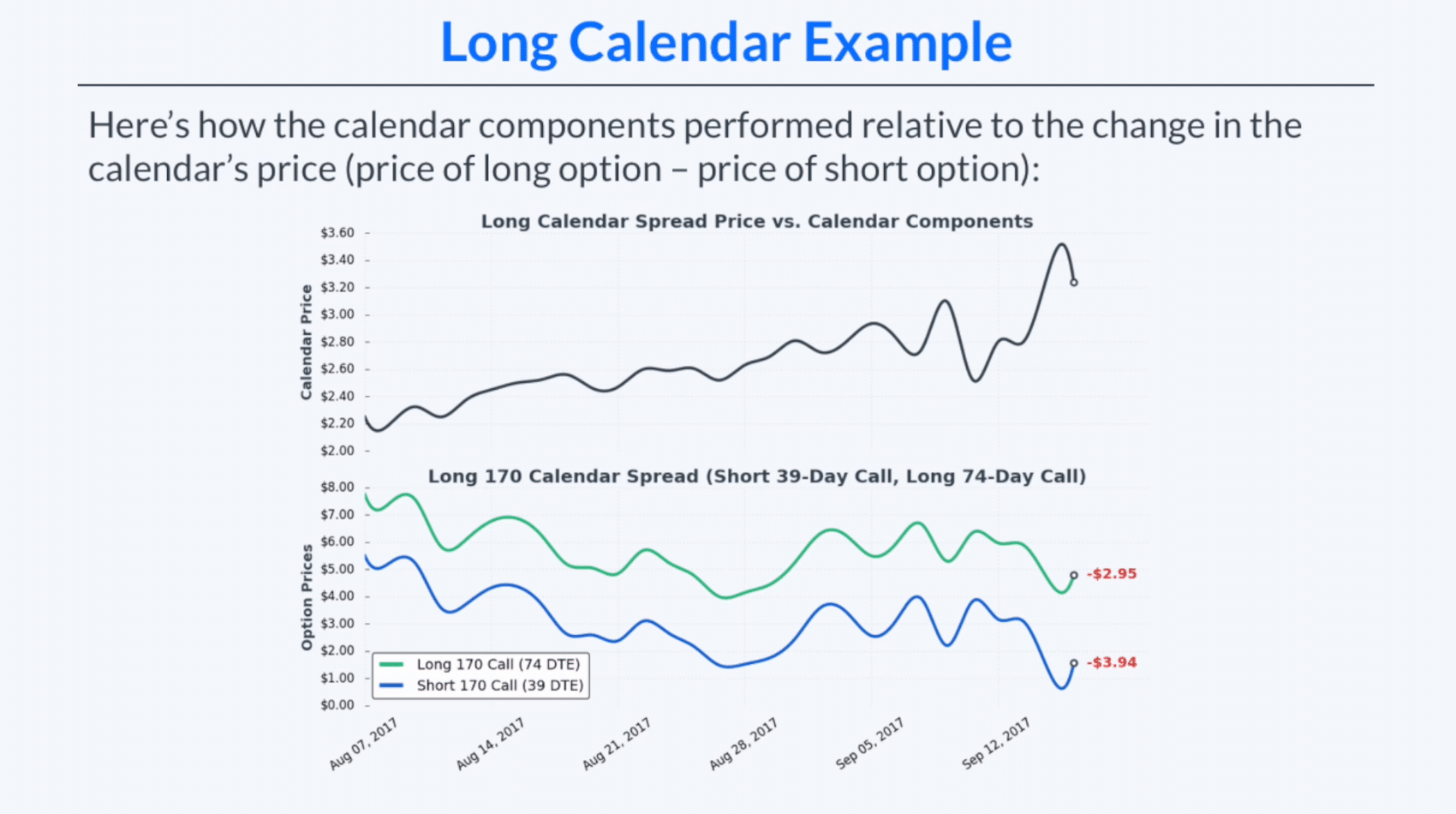

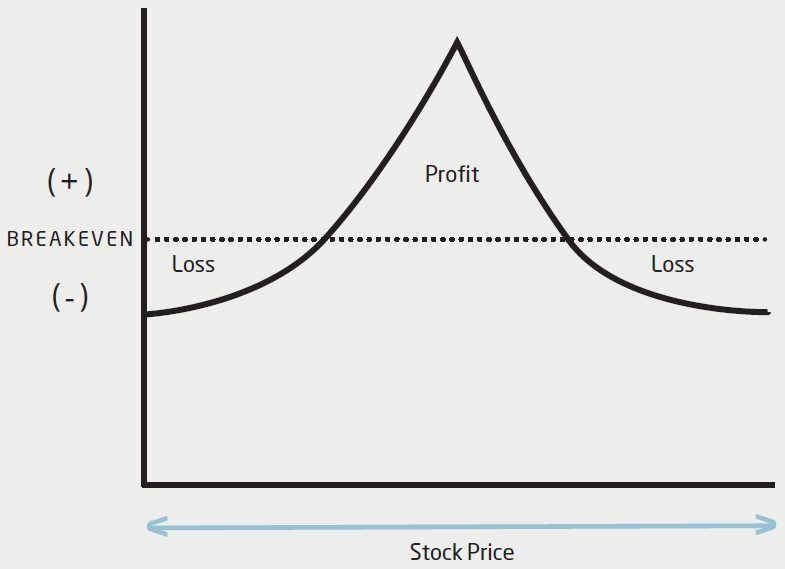

Long Call Calendar Spread - Web a calendar spread (time spread) refers to selling a near term expiry option and buying a longer term expiry option, at the same strike. Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously. Web the calendar spread. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration. Web what is a long call calendar spread? Web a long calendar call spread is an options strategy that involves buying and selling call options with different expiration months but the same strike price. Description short one call option and. Web calendar spread definition: This strategy can be done with either calls. Options strategies labeled as calendar spreads, simply mean you are execute a spread, but with contracts at the same strike price but with different. Web what is a long call calendar spread? Web calendar spread definition: Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with. Description short one call option and. Web a calendar spread (time spread) refers to selling a near term expiry option and buying. Web what is a long call calendar spread? In options trading, a “calendar spread” is a financial term used to describe a strategy that consists of buying and selling two options. Description short one call option and. Web calendar spread definition: Running a calendar spread with calls means you’re selling and buying a call with the same strike price, but. Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously. Web a long calendar call spread is an options strategy that involves buying and selling call options with different expiration months but the same strike price. Options strategies labeled as calendar spreads, simply mean you are execute a. Options strategies labeled as calendar spreads, simply mean you are execute a spread, but with contracts at the same strike price but with different. Web a calendar spread (time spread) refers to selling a near term expiry option and buying a longer term expiry option, at the same strike. In options trading, a “calendar spread” is a financial term used. Web a calendar call spread is an options strategy where two calls are traded on the same underlying and the same strike, one long and one short. This strategy profits from a decrease in the underlying price. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes. Web calendar spread definition: Description short one call option and. Web the calendar spread. Web a calendar call spread is an options strategy where two calls are traded on the same underlying and the same strike, one long and one short. Web a calendar spread (time spread) refers to selling a near term expiry option and buying a longer term. Web a calendar spread (time spread) refers to selling a near term expiry option and buying a longer term expiry option, at the same strike. Web calendar spread definition: Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with. Web a calendar call spread. Web what is a long call calendar spread? Options strategies labeled as calendar spreads, simply mean you are execute a spread, but with contracts at the same strike price but with different. Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously. Web a long calendar call spread. Web a calendar call spread is an options strategy where two calls are traded on the same underlying and the same strike, one long and one short. In options trading, a “calendar spread” is a financial term used to describe a strategy that consists of buying and selling two options. Running a calendar spread with calls means you’re selling and. Web the calendar spread. Running a calendar spread with calls means you’re selling and buying a call with the same strike price, but the call you buy will have a later expiration. Web a calendar spread (time spread) refers to selling a near term expiry option and buying a longer term expiry option, at the same strike. Web calendar spread. Options strategies labeled as calendar spreads, simply mean you are execute a spread, but with contracts at the same strike price but with different. In options trading, a “calendar spread” is a financial term used to describe a strategy that consists of buying and selling two options. This strategy can be done with either calls. Web a long calendar call spread is an options strategy that involves buying and selling call options with different expiration months but the same strike price. Web the calendar spread. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration. Web what is a long call calendar spread? Web a calendar call spread is an options strategy where two calls are traded on the same underlying and the same strike, one long and one short. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with. Web a calendar spread (time spread) refers to selling a near term expiry option and buying a longer term expiry option, at the same strike. Web calendar spread definition: This strategy profits from a decrease in the underlying price. Running a calendar spread with calls means you’re selling and buying a call with the same strike price, but the call you buy will have a later expiration. Web a calendar spread involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike price, but at different. Description short one call option and. Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously. This strategy profits from a decrease in the underlying price. Web a long calendar call spread is an options strategy that involves buying and selling call options with different expiration months but the same strike price. Web a calendar call spread is an options strategy where two calls are traded on the same underlying and the same strike, one long and one short. This strategy can be done with either calls. Web what is a long call calendar spread? Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with. In options trading, a “calendar spread” is a financial term used to describe a strategy that consists of buying and selling two options. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration. Web calendar spread definition: Options strategies labeled as calendar spreads, simply mean you are execute a spread, but with contracts at the same strike price but with different. Description short one call option and.Long Calendar Spreads Unofficed

Call Calendar Spread

How to Trade Options Calendar Spreads (Visuals and Examples)

Can I Do Calendar Spreads In Robinhood Option Strategies Which Are

Long Call Calendar Long call calendar Spread Calendar Spread YouTube

Calendar Call Spread Options Edge

Long Calendar Spreads for Beginner Options Traders projectfinance

Glossary Definition Horizontal Call Calendar Spread Tackle Trading

The Long Calendar Spread Explained 1 Options Trading Software

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web The Calendar Spread.

Web A Calendar Spread Involves Buying And Selling The Same Type Of Option (Calls Or Puts) For The Same Underlying Security At The Same Strike Price, But At Different.

Web A Calendar Spread (Time Spread) Refers To Selling A Near Term Expiry Option And Buying A Longer Term Expiry Option, At The Same Strike.

Running A Calendar Spread With Calls Means You’re Selling And Buying A Call With The Same Strike Price, But The Call You Buy Will Have A Later Expiration.

Related Post:

![Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019ad90afc0a18011924af0_3Ui8KuFuRxcjUyFQ2mvscNmGIXALxE0ESnrXkoAAqNejP5Ygrj-dyv3Kfo-1jmOjFg2axgrXs-MriQsNl-6is4rU-lDczPVaDzlttqUjTEJIvT6pRF0GK8qSlYVoNo6r5r07P-gi.png)