Futures Calendar Spread

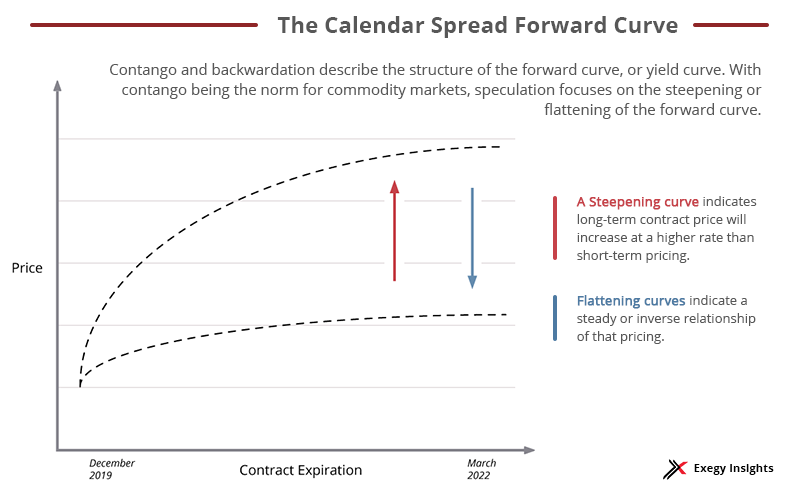

Futures Calendar Spread - Web calendar spreads and the roll for any given futures product, a standard calendar spread is a transaction that combines the purchase of a futures contract for. Web key takeaways a futures spread is an arbitrage technique in which a trader takes offsetting positions on a commodity in order to. Futures trading is a very volatile. Web calendar spread options (cso) are options on the spread between two futures contract months, rather than a single underlying contract month. Web summary a calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a. Web learn how to options on futures calendar spreads to design a position that minimizes loss potential while offering possibility of tremendous profit. Intramarket spreads, also referred to as calendar spreads, involve buying a futures contract in one month while simultaneously selling the same. Web a calendar spread is an investment strategy in which the investor buys and sells a derivative contract (an option or futures contract) for the same underlying security. Web calendar spreads in futures calendar spreads are complex orders with contract legs—one long, one short—for the same product but different expiration months. Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a particular. Web summary a calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a. A futures contract is a legally binding agreement to buy or sell a standardized asset on a specific date or during a specific month. Unlike vanilla options, in which. Web learn how to options on. Web calendar spreads in futures calendar spreads are complex orders with contract legs—one long, one short—for the same product but different expiration months. The economic calendar page keeps track of all the important events and economic indicators that drive the markets. Web learn how to options on futures calendar spreads to design a position that minimizes loss potential while offering. Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a particular. Web learn how to options on futures calendar spreads to design a position that minimizes loss potential while offering possibility of tremendous profit. Calendar spread options are options on the. Web learn how to options on futures calendar spreads to design a position that minimizes loss potential while offering possibility of tremendous profit. Web calendar spreads in futures calendar spreads are complex orders with contract legs—one long, one short—for the same product but different expiration months. Unlike vanilla options, in which. Web summary a calendar spread is a trading technique. Web calendar spreads in futures calendar spreads are complex orders with contract legs—one long, one short—for the same product but different expiration months. Web calendar spreads and the roll for any given futures product, a standard calendar spread is a transaction that combines the purchase of a futures contract for. Calendar spread options are options on the price differential between. Web a calendar spread is an investment strategy in which the investor buys and sells a derivative contract (an option or futures contract) for the same underlying security. Web calendar spread options (cso) are options on the spread between two futures contract months, rather than a single underlying contract month. Web calendar spreads and the roll for any given futures. The economic calendar page keeps track of all the important events and economic indicators that drive the markets. Intramarket spreads, also referred to as calendar spreads, involve buying a futures contract in one month while simultaneously selling the same. Web calendar spread options (cso) are options on the spread between two futures contract months, rather than a single underlying contract. Intramarket spreads, also referred to as calendar spreads, involve buying a futures contract in one month while simultaneously selling the same. Calendar spread options are options on the price differential between 2 contract months, rather than on the underlying asset itself. Web learn how to options on futures calendar spreads to design a position that minimizes loss potential while offering. Futures trading is a very volatile. Web summary a calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a. Web calendar spreads and the roll for any given futures product, a standard calendar spread is a transaction that combines the purchase of a futures contract for. Web key. Web key takeaways a futures spread is an arbitrage technique in which a trader takes offsetting positions on a commodity in order to. Web calendar spread options (cso) are options on the spread between two futures contract months, rather than a single underlying contract month. Calendar spread options are options on the price differential between 2 contract months, rather than. Web summary a calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a. Calendar spread options are options on the price differential between 2 contract months, rather than on the underlying asset itself. Intramarket spreads, also referred to as calendar spreads, involve buying a futures contract in one month while simultaneously selling the same. Web a calendar spread is an investment strategy in which the investor buys and sells a derivative contract (an option or futures contract) for the same underlying security. Web key takeaways a futures spread is an arbitrage technique in which a trader takes offsetting positions on a commodity in order to. Web calendar spread options (cso) are options on the spread between two futures contract months, rather than a single underlying contract month. A futures contract is a legally binding agreement to buy or sell a standardized asset on a specific date or during a specific month. Web calendar spreads in futures calendar spreads are complex orders with contract legs—one long, one short—for the same product but different expiration months. Unlike vanilla options, in which. The economic calendar page keeps track of all the important events and economic indicators that drive the markets. Web calendar spreads and the roll for any given futures product, a standard calendar spread is a transaction that combines the purchase of a futures contract for. Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a particular. Futures trading is a very volatile. Web futures are financial contracts obligating the buyer to purchase an asset or the seller to sell an asset, such as a physical commodity or a financial instrument , at a. Web learn how to options on futures calendar spreads to design a position that minimizes loss potential while offering possibility of tremendous profit. Web a calendar spread is an investment strategy in which the investor buys and sells a derivative contract (an option or futures contract) for the same underlying security. The economic calendar page keeps track of all the important events and economic indicators that drive the markets. Web futures are financial contracts obligating the buyer to purchase an asset or the seller to sell an asset, such as a physical commodity or a financial instrument , at a. Web summary a calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a. Calendar spread options are options on the price differential between 2 contract months, rather than on the underlying asset itself. Web learn how to options on futures calendar spreads to design a position that minimizes loss potential while offering possibility of tremendous profit. A futures contract is a legally binding agreement to buy or sell a standardized asset on a specific date or during a specific month. Web calendar spread options (cso) are options on the spread between two futures contract months, rather than a single underlying contract month. Unlike vanilla options, in which. Futures trading is a very volatile. Web key takeaways a futures spread is an arbitrage technique in which a trader takes offsetting positions on a commodity in order to. Web calendar spreads and the roll for any given futures product, a standard calendar spread is a transaction that combines the purchase of a futures contract for.Getting Started with Calendar Spreads in Futures Exegy

Futures Calendar Spread trading Crude Oil scalping YouTube

Futures Calendar Spreads on Interactive Brokers 30 Day Trading30 Day

Seasonal Futures Spreads Calendar Spread with Feeder Cattle futures X5F6

Calendar Spread In Futures CALNDA

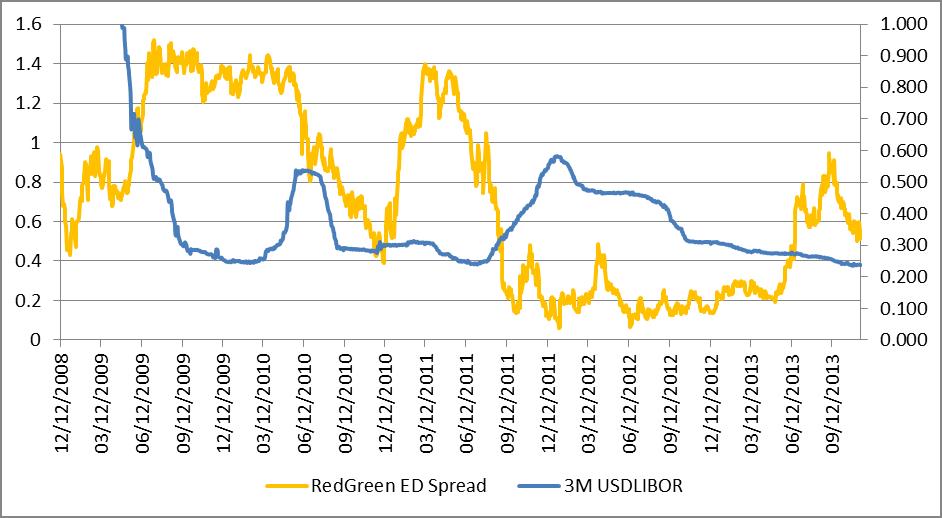

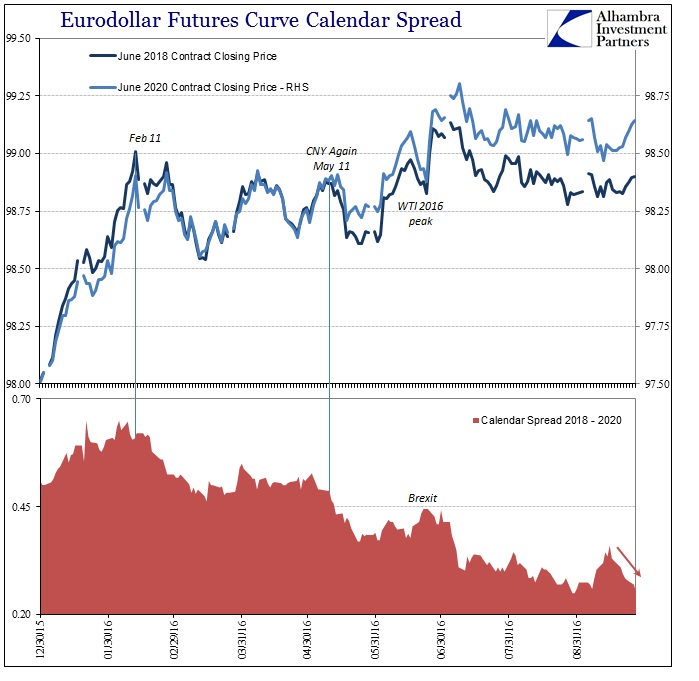

eurodollar to STIR futures

No Need For Yield Curve Inversion (There Is Already Much Worse

Calendar Spread In Futures CALNDA

Do I Need A License To Teach Stock Trading Calendar Spread Algo Trading

Futures Curve by Accutic Treasury Futures Calendar Spreads

Intramarket Spreads, Also Referred To As Calendar Spreads, Involve Buying A Futures Contract In One Month While Simultaneously Selling The Same.

Web Calendar Spreads In Futures Calendar Spreads Are Complex Orders With Contract Legs—One Long, One Short—For The Same Product But Different Expiration Months.

Web In Finance, A Calendar Spread (Also Called A Time Spread Or Horizontal Spread) Is A Spread Trade Involving The Simultaneous Purchase Of Futures Or Options Expiring On A Particular.

Related Post: