Diagonal Calendar Spread

Diagonal Calendar Spread - Web the short diagonal calendar put spread is one of two types of short calendar spreads utilizing only put options. Web if two different strike prices are used for each month, it is known as a diagonal spread. Web how does diagonal calendar put spread work in options trading? Web a diagonal spread is similar to a calendar spread with the only difference being that the strikes are different. Web the diagonal spread is a popular options trading strategy that involves the simultaneous purchase and sale of options of the same type but with different strike prices and. Web one reason to like trading diagonal spreads is that they lend themselves to numerous position adjustments during the trading process. Web a call diagonal spread is a combination of a bear call credit spread and a call calendar spread. The diagonal calendar put spread, also known as the put. Web diagonal calendar spread. Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a. Web if two different strike prices are used for each month, it is known as a diagonal spread. It is an options strategy established by simultaneously entering into a long and short position in two options of the same type—two call options or two put options—but with different strike prices and different expiration dates. The spread is known as diagonal. A diagonal spread is a modified calendar spread involving different strike prices. A diagonal calendar spread uses different strike prices for the two options positions. Web the diagonal calendar call spread, also known as the calendar diagonal call spread, is a neutral options strategy that profits when the underlying stock remains within a. Web diagonal calendar spread. For example, say. The other one is the short horizontal calendar put spread. Web how does diagonal calendar put spread work in options trading? For example, say we initiate. Web a diagonal spread is a hybrid of a bull call spread or a bear put spread, combined with a calendar spread. Web a call diagonal spread is a combination of a bear call. Web if two different strike prices are used for each month, it is known as a diagonal spread. Here's a screenshot of what would officially be called a calendar. Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a.. Web diagonal calendar spread. Web the diagonal spread is a popular options trading strategy that involves the simultaneous purchase and sale of options of the same type but with different strike prices and. The diagonal calendar put spread, also known as the put. Here's a screenshot of what would officially be called a calendar. For example, say we initiate. Web a diagonal spread is a hybrid of a bull call spread or a bear put spread, combined with a calendar spread. The other one is the short horizontal calendar put spread. Web the diagonal calendar call spread, also known as the calendar diagonal call spread, is a neutral options strategy that profits when the underlying stock remains within a.. For example, say we initiate. Web diagonal calendar spread. A diagonal calendar spread uses different strike prices for the two options positions. Web a diagonal spread is similar to a calendar spread with the only difference being that the strikes are different. Web a call diagonal spread is a combination of a bear call credit spread and a call calendar. Web the diagonal spread is a popular options trading strategy that involves the simultaneous purchase and sale of options of the same type but with different strike prices and. Web a diagonal spread is a hybrid of a bull call spread or a bear put spread, combined with a calendar spread. Web one reason to like trading diagonal spreads is. Web the diagonal calendar call spread, also known as the calendar diagonal call spread, is a neutral options strategy that profits when the underlying stock remains within a. A diagonal spread is a modified calendar spread involving different strike prices. The spread is known as diagonal spread as it. The other one is the short horizontal calendar put spread. Web. Web if two different strike prices are used for each month, it is known as a diagonal spread. Web the diagonal spread is an option spread strategy that involves the simultaneous purchase and sale of equal number of options of the same class, same underlying security with. Web diagonal calendar spread. Web the short diagonal calendar put spread is one. Web one reason to like trading diagonal spreads is that they lend themselves to numerous position adjustments during the trading process. Web if two different strike prices are used for each month, it is known as a diagonal spread. It is an options strategy established by simultaneously entering into a long and short position in two options of the same type—two call options or two put options—but with different strike prices and different expiration dates. Web the diagonal spread is a popular options trading strategy that involves the simultaneous purchase and sale of options of the same type but with different strike prices and. Web the diagonal spread is an option spread strategy that involves the simultaneous purchase and sale of equal number of options of the same class, same underlying security with. A diagonal spread is a modified calendar spread involving different strike prices. For example, say we initiate. Here's a screenshot of what would officially be called a calendar. Web the diagonal calendar call spread, also known as the calendar diagonal call spread, is a neutral options strategy that profits when the underlying stock remains within a. A diagonal calendar spread uses different strike prices for the two options positions. Web a call diagonal spread is a combination of a bear call credit spread and a call calendar spread. The spread is known as diagonal spread as it. Web how does diagonal calendar put spread work in options trading? Web a diagonal spread is similar to a calendar spread with the only difference being that the strikes are different. The other one is the short horizontal calendar put spread. Web the short diagonal calendar put spread is one of two types of short calendar spreads utilizing only put options. The diagonal calendar put spread, also known as the put. Web a diagonal spread is a hybrid of a bull call spread or a bear put spread, combined with a calendar spread. Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a. Web diagonal calendar spread. A diagonal calendar spread uses different strike prices for the two options positions. Web the short diagonal calendar put spread is one of two types of short calendar spreads utilizing only put options. Web the diagonal calendar call spread, also known as the calendar diagonal call spread, is a neutral options strategy that profits when the underlying stock remains within a. The other one is the short horizontal calendar put spread. Web if two different strike prices are used for each month, it is known as a diagonal spread. Web the diagonal spread is an option spread strategy that involves the simultaneous purchase and sale of equal number of options of the same class, same underlying security with. Here's a screenshot of what would officially be called a calendar. Web diagonal calendar spread. Web the diagonal spread is a popular options trading strategy that involves the simultaneous purchase and sale of options of the same type but with different strike prices and. The diagonal calendar put spread, also known as the put. Web a diagonal spread is a hybrid of a bull call spread or a bear put spread, combined with a calendar spread. Web how does diagonal calendar put spread work in options trading? For example, say we initiate. Web one reason to like trading diagonal spreads is that they lend themselves to numerous position adjustments during the trading process. Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a. A diagonal spread is a modified calendar spread involving different strike prices.DIAGONAL WEEKLY CALENDAR WITH ADJUSTMENTS WEEKLY CALENDAR SPREAD

Glossary Archive Tackle Trading

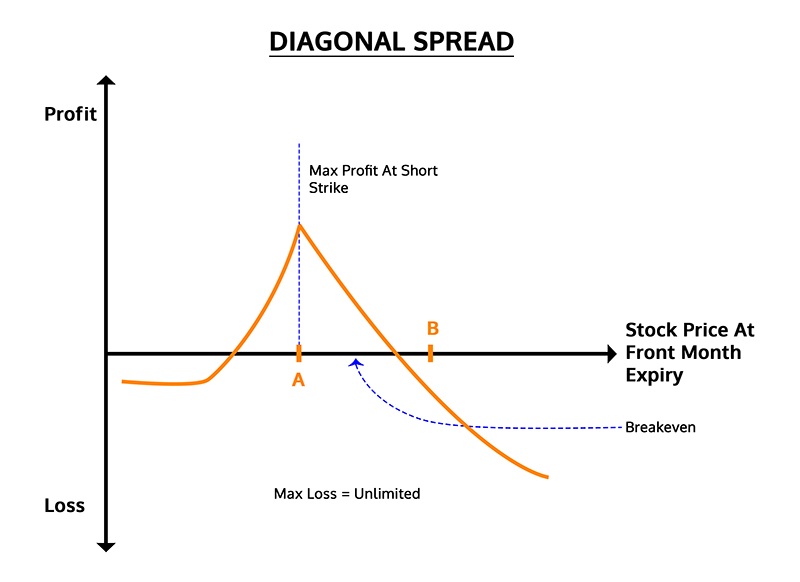

Diagonal Spread Options Trading Strategy In Python

Calendar Diagonal Option Spread [Why FB]? YouTube

Case Study Goldman Sachs Double Calendar and Double Diagonal

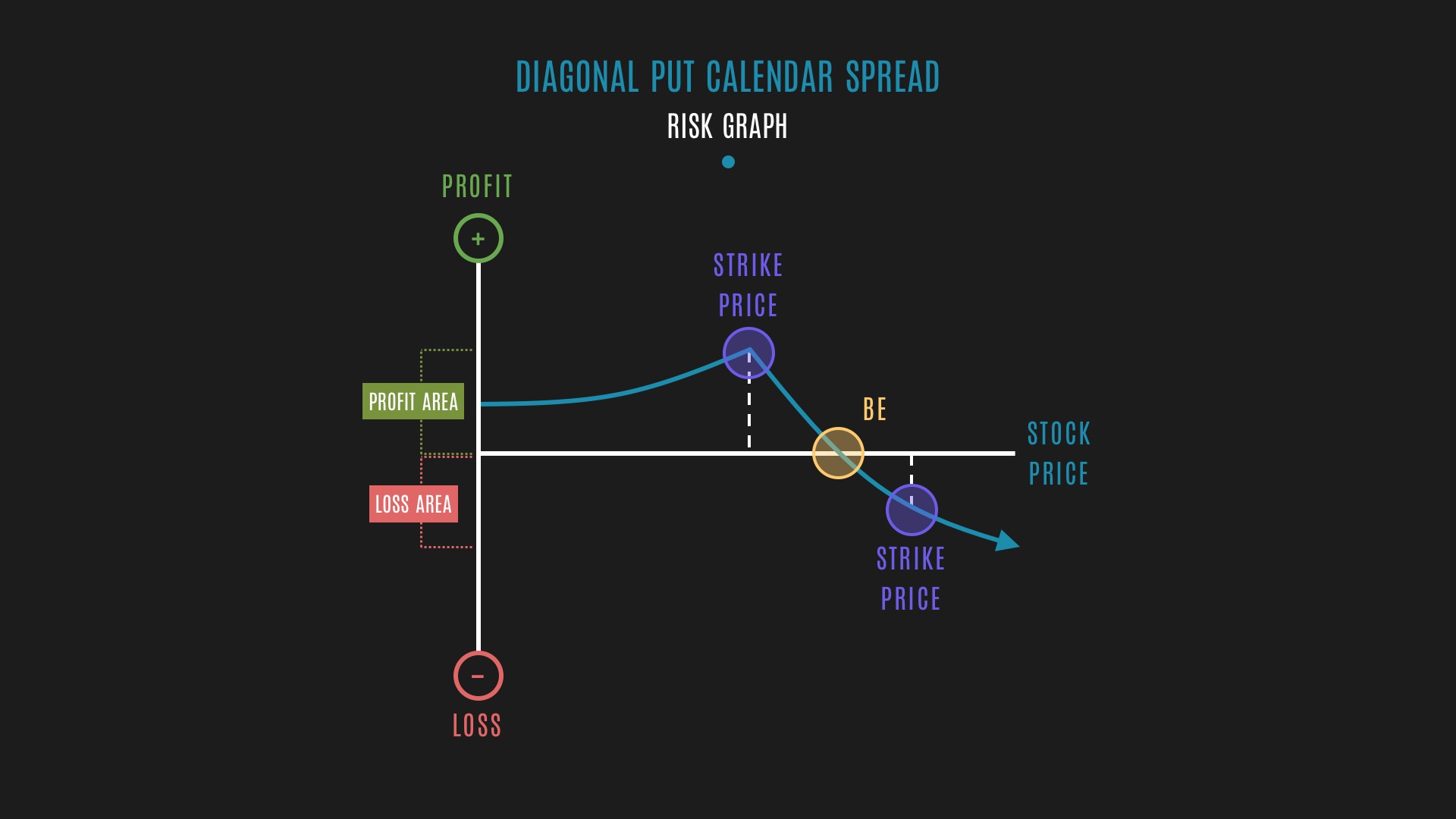

Glossary Diagonal Put Calendar Spread example Tackle Trading

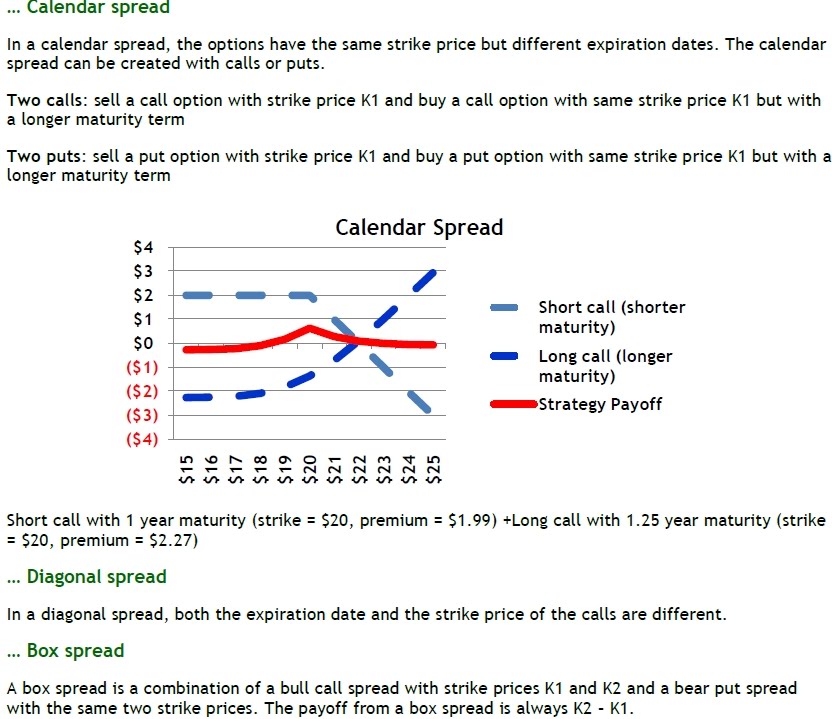

kthwow calendar spread, diagonal spread, box spread

Pin on CALENDAR SPREADS OPTIONS

Pin on Double Calendar Spreads and Adjustments

Diagonal Call Calendar Spread Smart Trading

Web A Call Diagonal Spread Is A Combination Of A Bear Call Credit Spread And A Call Calendar Spread.

The Spread Is Known As Diagonal Spread As It.

Web A Diagonal Spread Is Similar To A Calendar Spread With The Only Difference Being That The Strikes Are Different.

It Is An Options Strategy Established By Simultaneously Entering Into A Long And Short Position In Two Options Of The Same Type—Two Call Options Or Two Put Options—But With Different Strike Prices And Different Expiration Dates.

Related Post:

![Calendar Diagonal Option Spread [Why FB]? YouTube](https://i.ytimg.com/vi/qjfTMDLcmew/maxresdefault.jpg)