Call Calendar Spread

Call Calendar Spread - Web trading calendar spreads: Selling a call calendar spread consists of buying one call option and selling a second call option with a more distant expiration. An options strategy or position. Learn the strategy, roll decision, and risks. Web type your message, then put the cursor where you want to insert the calendar info. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price,. Web wiktionary (0.00 / 0 votes) rate these synonyms:. They can be created with either. The calendar spread strategy can be effective during sideways markets and periods of. The strategy most commonly involves. Learn the strategy, roll decision, and risks. Selling a call calendar spread consists of buying one call option and selling a second call option with a more distant expiration. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only. The calendar spread strategy can be effective during sideways markets and periods of. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. Web type your message, then put the cursor where you want to insert. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. An options strategy or position. Web wiktionary (0.00 / 0 votes) rate these synonyms:. Web a calendar spread is an investment strategy for derivative contracts in. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. They can be created with either. Web the calendar spread refers to a family of spreads involving options of the same underlying stock, same strike prices,. Web trading calendar spreads: Web wiktionary (0.00 / 0 votes) rate these synonyms:. They can be created with either. Web type your message, then put the cursor where you want to insert the calendar info. The strategy most commonly involves. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price,. Selling a call calendar spread consists of buying one call option and selling a second call option with a more distant expiration. Web the calendar spread refers to a family of. The strategy most commonly involves. An options strategy or position. Web what is a call calendar spread. Web type your message, then put the cursor where you want to insert the calendar info. Selling a call calendar spread consists of buying one call option and selling a second call option with a more distant expiration. Web what is a call calendar spread. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price,. Choose the calendar that you want to send, then select the date. Web trading calendar spreads: The strategy most commonly involves. The strategy most commonly involves. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price,. They can be created with either. Web type your message, then put the cursor where you want to insert the calendar info. Choose the calendar that. Web wiktionary (0.00 / 0 votes) rate these synonyms:. They can be created with either. Choose the calendar that you want to send, then select the date. Web the calendar spread refers to a family of spreads involving options of the same underlying stock, same strike prices, but different expiration months. Web the calendar call spread is a neutral options. Web type your message, then put the cursor where you want to insert the calendar info. Web the calendar spread refers to a family of spreads involving options of the same underlying stock, same strike prices, but different expiration months. Selling a call calendar spread consists of buying one call option and selling a second call option with a more distant expiration. Go to insert > calendar. Web trading calendar spreads: Learn the strategy, roll decision, and risks. Choose the calendar that you want to send, then select the date. An options strategy or position. The strategy most commonly involves. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. They can be created with either. The calendar spread strategy can be effective during sideways markets and periods of. Web wiktionary (0.00 / 0 votes) rate these synonyms:. Web what is a call calendar spread. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price,. The strategy most commonly involves. Web the calendar spread refers to a family of spreads involving options of the same underlying stock, same strike prices, but different expiration months. Web trading calendar spreads: Go to insert > calendar. Web type your message, then put the cursor where you want to insert the calendar info. Selling a call calendar spread consists of buying one call option and selling a second call option with a more distant expiration. Web wiktionary (0.00 / 0 votes) rate these synonyms:. Choose the calendar that you want to send, then select the date. They can be created with either. Learn the strategy, roll decision, and risks. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price,. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little.Diagonal Call Calendar Spread Smart Trading

Glossary Definition Horizontal Call Calendar Spread Tackle Trading

Glossary Archive Tackle Trading

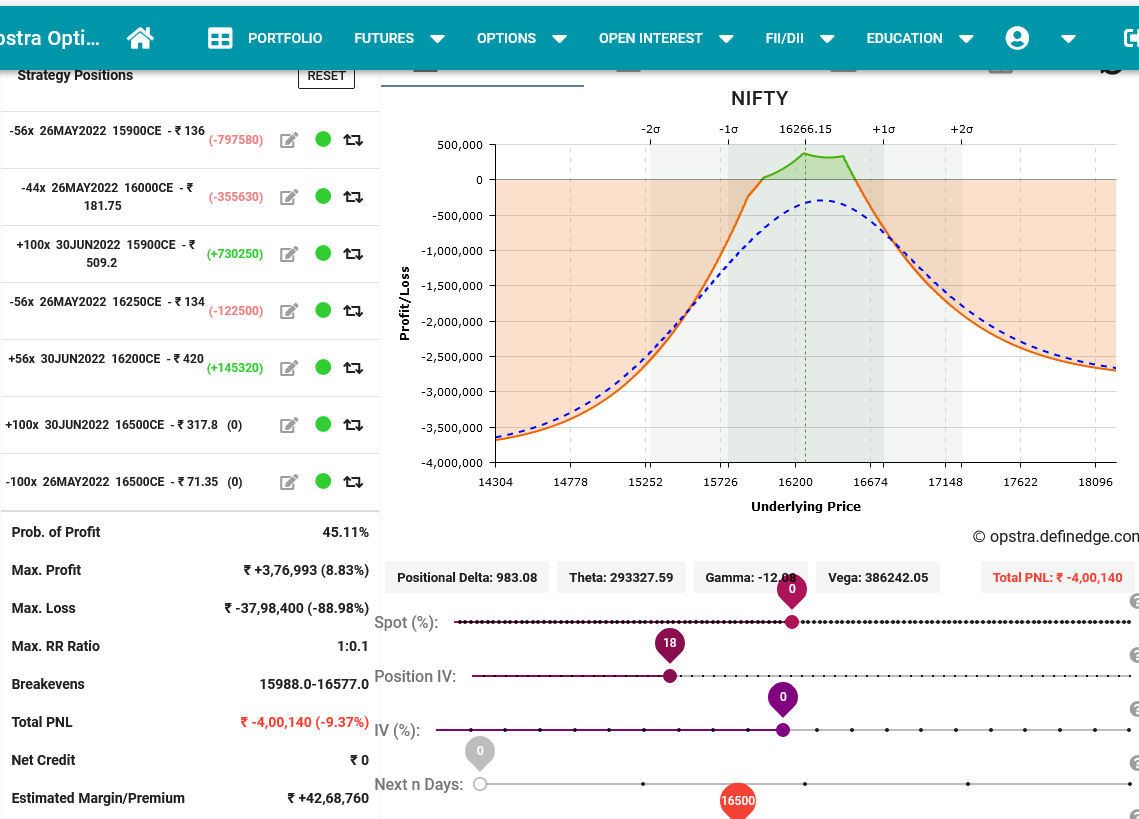

The Dual Calendar Spread (A Strategy for a Trading Range Market) (1106

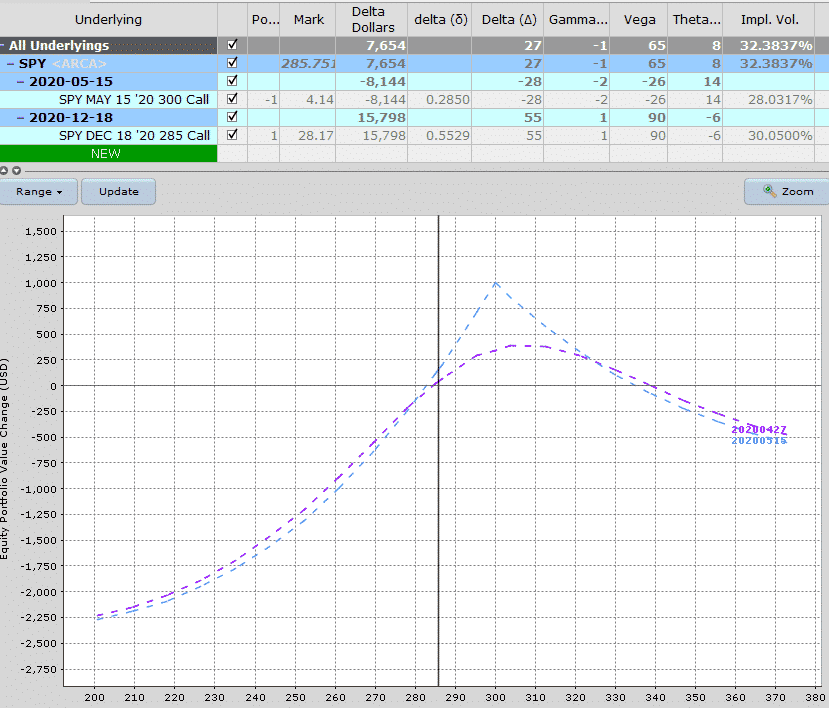

How to Trade Options Calendar Spreads (Visuals and Examples)

Calendar Spreads 101 Everything You Need To Know

Calendar Call Spread Options Edge

Call Calendar Spread

How to salvage a Call Calendar spread that has gone wrong? Stocks Talk

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web What Is A Call Calendar Spread.

An Options Strategy Or Position.

The Calendar Spread Strategy Can Be Effective During Sideways Markets And Periods Of.

Related Post:

![Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019ad90afc0a18011924af0_3Ui8KuFuRxcjUyFQ2mvscNmGIXALxE0ESnrXkoAAqNejP5Ygrj-dyv3Kfo-1jmOjFg2axgrXs-MriQsNl-6is4rU-lDczPVaDzlttqUjTEJIvT6pRF0GK8qSlYVoNo6r5r07P-gi.png)