Calendar Spread Calculator

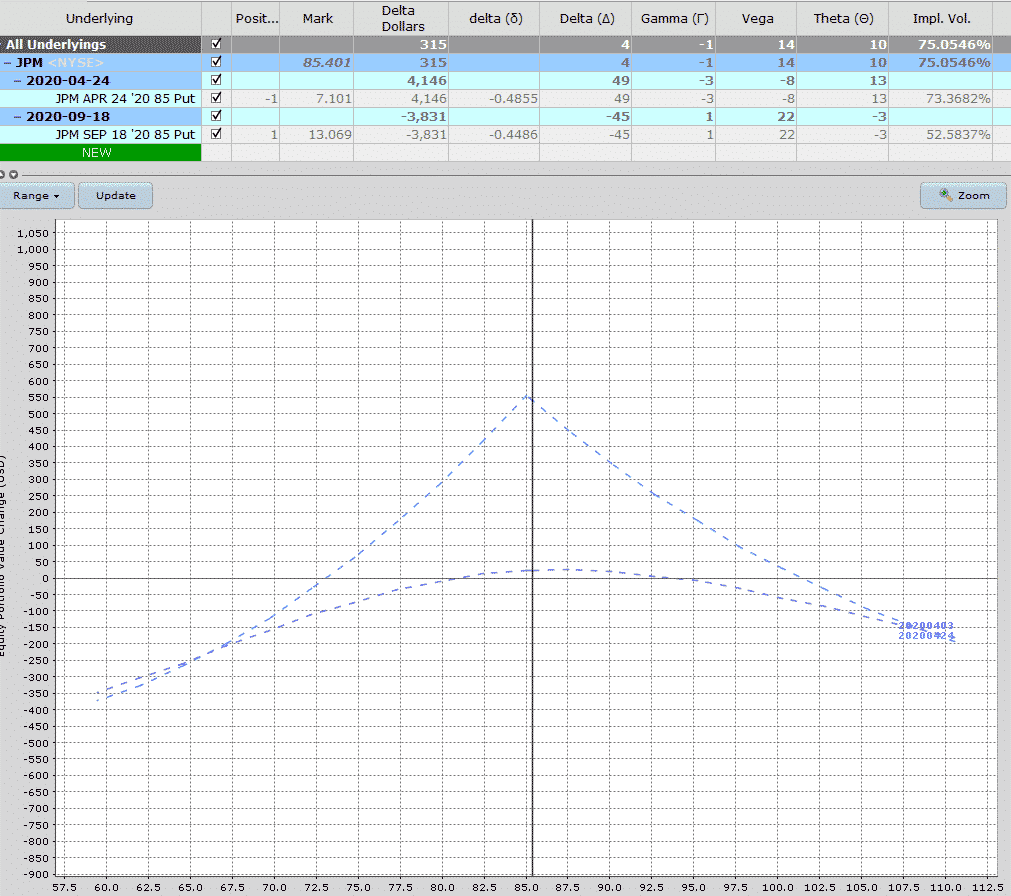

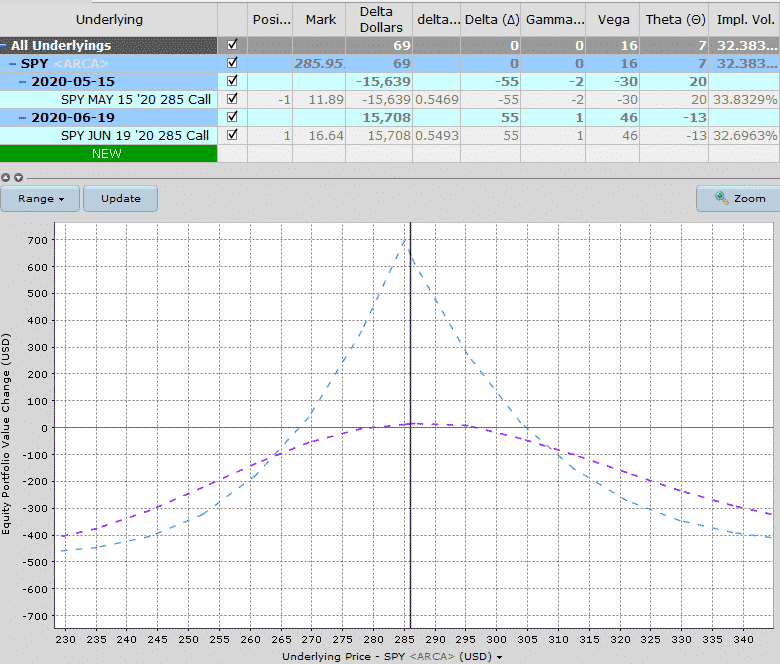

Calendar Spread Calculator - Web enter a start date and add or subtract any number of days, months, or years. Duration between two times and dates. Web the calendar put spread calculator can be used to chart theoretical profit and loss (p&l) for a calendar put position. Web gordon scott what is a calendar spread? A calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same. Web anytime you adjust a position, or roll a position to a new expiration cycle, it can be extremely confusing on how to figure out your profit or loss. Web a calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a derivative of the same asset in another. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price,. Clicking on the chart icon on the calendar put spread. Web because your long spread has “widened” from $1 to $2, your profit, if you were able to sell to close that position, would be $1 minus transaction costs. Web anytime you adjust a position, or roll a position to a new expiration cycle, it can be extremely confusing on how to figure out your profit or loss. Web the calendar put spread calculator can be used to chart theoretical profit and loss (p&l) for a calendar put position. Web a calendar spread is a trading technique that involves. Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a. Web enter a start date and add or subtract any number of days, months, or years. Web anytime you adjust a position, or roll a position to a new. Web because your long spread has “widened” from $1 to $2, your profit, if you were able to sell to close that position, would be $1 minus transaction costs. How many years, months, days, hours, minutes, and seconds are there between two moments in time? A calendar spread is an options or futures strategy established by simultaneously entering a long. Web calendar spreads defined. Web anytime you adjust a position, or roll a position to a new expiration cycle, it can be extremely confusing on how to figure out your profit or loss. Count days add days workdays add workdays weekday week № start date month: A calendar spread, also known as a horizontal spread, is created with a simultaneous. How many years, months, days, hours, minutes, and seconds are there between two moments in time? Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price,. Count days add days workdays add workdays weekday week № start date month: Web updated. Web learn how to options on futures calendar spreads to design a position that minimizes loss potential while offering possibility of tremendous profit. Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option trading strategies offer traders and investors the opportunity to. A calendar spread is an options or futures strategy established by simultaneously entering. Web calendar spreads defined. Web a calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a derivative of the same asset in another. Web the calendar put spread calculator can be used to chart theoretical profit and loss (p&l) for a calendar put position. Web learn how to. A calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same. Duration between two times and dates. Web because your long spread has “widened” from $1 to $2, your profit, if you were able to sell to close that position, would be $1 minus transaction costs. Web enter. Clicking on the chart icon on the calendar put spread. Web because your long spread has “widened” from $1 to $2, your profit, if you were able to sell to close that position, would be $1 minus transaction costs. Web a calendar spread is a trading technique that involves the buying of a derivative of an asset in one month. Web gordon scott what is a calendar spread? A calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same. Web enter a start date and add or subtract any number of days, months, or years. How many years, months, days, hours, minutes, and seconds are there between two. Web anytime you adjust a position, or roll a position to a new expiration cycle, it can be extremely confusing on how to figure out your profit or loss. Web the calendar put spread calculator can be used to chart theoretical profit and loss (p&l) for a calendar put position. Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option trading strategies offer traders and investors the opportunity to. Web enter a start date and add or subtract any number of days, months, or years. Web gordon scott what is a calendar spread? Web calendar spreads defined. A calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same. How many years, months, days, hours, minutes, and seconds are there between two moments in time? Duration between two times and dates. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price,. Clicking on the chart icon on the calendar put spread. Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a. Count days add days workdays add workdays weekday week № start date month: A calendar spread is an options or futures strategy established by simultaneously entering a long and short position on. Web a calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a derivative of the same asset in another. Web learn how to options on futures calendar spreads to design a position that minimizes loss potential while offering possibility of tremendous profit. Web because your long spread has “widened” from $1 to $2, your profit, if you were able to sell to close that position, would be $1 minus transaction costs. Web gordon scott what is a calendar spread? Web a calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a derivative of the same asset in another. Web calendar spreads defined. How many years, months, days, hours, minutes, and seconds are there between two moments in time? Web the calendar put spread calculator can be used to chart theoretical profit and loss (p&l) for a calendar put position. Web enter a start date and add or subtract any number of days, months, or years. Clicking on the chart icon on the calendar put spread. Web (april 2020) in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a. A calendar spread is an options or futures strategy established by simultaneously entering a long and short position on. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price,. Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option trading strategies offer traders and investors the opportunity to. Count days add days workdays add workdays weekday week № start date month: Web anytime you adjust a position, or roll a position to a new expiration cycle, it can be extremely confusing on how to figure out your profit or loss.Calendar Spread Option Calculator CALNDA

Pin on Option Trading Strategies

27+ calendar spread calculator AlveyAlfaigh

Pin on Calendar Spreads Options

Pin on CALENDAR SPREADS OPTIONS

Calendar Call Spread Calculator

Calendar Spreads 101 Everything You Need To Know

27+ calendar spread calculator AlveyAlfaigh

Pin on CALENDAR SPREADS OPTIONS

How To Trade Calendar Spreads The Complete Guide

Web Learn How To Options On Futures Calendar Spreads To Design A Position That Minimizes Loss Potential While Offering Possibility Of Tremendous Profit.

A Calendar Spread, Also Known As A Horizontal Spread, Is Created With A Simultaneous Long And Short Position In Options On The Same.

Duration Between Two Times And Dates.

Web Because Your Long Spread Has “Widened” From $1 To $2, Your Profit, If You Were Able To Sell To Close That Position, Would Be $1 Minus Transaction Costs.

Related Post: