Benefit Year Vs Calendar Year

Benefit Year Vs Calendar Year - All individual plans now have the calendar year match the plan year, meaning no matter when you buy the. Web benefit year a year of benefits coverage under an individual health insurance plan. The day provides many resources for benefits professionals to explore the tools and packages available to employees and employers. The benefit year for plans bought inside or outside the marketplace begins january 1 of each. The benefit year for plans bought inside or outside the marketplace begins january 1 of each year and ends. Web what is the difference between group plan year and calendar year? Can we setup our plans so the limits follow the benefit year rather than the. This is a very common question. Our benefit year is 10/1 to 9/30. Web the deductible limit is the maximum amount covered in a given year a participant may have to pay before the plan coverage is required to satisfy the full amount of claim (s). Does an fsa have to be on a calendar year? Web the challenge of a fiscal year is that you have to be mindful of the impact of not using a calendar year. The calendar year is january 1 to december 31. Web when health insurance companies price their insurance premiums and design their plans, they do so based on. Web lexie optical learning center does an fsa have to be on a calendar year? Will reset every january 1. The day provides many resources for benefits professionals to explore the tools and packages available to employees and employers. Web during the calendar year, once you spend a certain amount on covered services, around $9,000, the insurance carrier begins to. Web benefit year a year of benefits coverage under an individual health insurance plan. The benefit year for plans bought inside or outside the marketplace begins january 1 of each year and ends. A flexible spending account plan year does not have. Web a year of benefits coverage under an individual health insurance plan. To find out when your plan. Can we setup our plans so the limits follow the benefit year rather than the. Web when health insurance companies price their insurance premiums and design their plans, they do so based on a calendar year. The day provides many resources for benefits professionals to explore the tools and packages available to employees and employers. To find out when your. Does an fsa have to be on a calendar year? A flexible spending account plan year does not have. The day provides many resources for benefits professionals to explore the tools and packages available to employees and employers. Web the deductible limit is the maximum amount covered in a given year a participant may have to pay before the plan. Web what is the difference between group plan year and calendar year? Receive up to $300 in annual travel credit as reimbursement for a wide array of travel purchases charged to your card each account anniversary year. The deductible limit is the maximum amount covered in a given year an. All individual plans now have the calendar year match the. Does an fsa have to be on a calendar year? A calendar year always begins on new year’s day and ends on the last day of. The benefit year for plans bought inside or outside the marketplace begins january 1 of each year and ends. Receive up to $300 in annual travel credit as reimbursement for a wide array of. Web when health insurance companies price their insurance premiums and design their plans, they do so based on a calendar year. Web here’s a quick and easy breakdown of the core differences between fiscal and calendar years: This is a very common question. Can we setup our plans so the limits follow the benefit year rather than the. Web the. Web during the calendar year, once you spend a certain amount on covered services, around $9,000, the insurance carrier begins to pick up the rest of your covered. Web many employers operate their health plans on a calendar year basis, from jan. Web the challenge of a fiscal year is that you have to be mindful of the impact of. A flexible spending account plan year does not have. Web many employers operate their health plans on a calendar year basis, from jan. A calendar year always begins on new year’s day and ends on the last day of. The deductible limit is the maximum amount covered in a given year an. The calendar year is january 1 to december. Web when health insurance companies price their insurance premiums and design their plans, they do so based on a calendar year. All individual plans now have the calendar year match the plan year, meaning no matter when you buy the. Web many employers operate their health plans on a calendar year basis, from jan. The day provides many resources for benefits professionals to explore the tools and packages available to employees and employers. Receive up to $300 in annual travel credit as reimbursement for a wide array of travel purchases charged to your card each account anniversary year. Can we setup our plans so the limits follow the benefit year rather than the. Web the challenge of a fiscal year is that you have to be mindful of the impact of not using a calendar year. A calendar year always begins on new year’s day and ends on the last day of. Web benefit year a year of benefits coverage under an individual health insurance plan. Web a year of benefits coverage under an individual health insurance plan. Our benefit year is 10/1 to 9/30. The benefit year for plans bought inside or outside the marketplace begins january 1 of each. Web what is the difference between group plan year and calendar year? The calendar year is january 1 to december 31. To find out when your plan year. Web during the calendar year, once you spend a certain amount on covered services, around $9,000, the insurance carrier begins to pick up the rest of your covered. Web the irs sets fsa and hsa limits based on calendar year. Does an fsa have to be on a calendar year? The benefit year for plans bought inside or outside the marketplace begins january 1 of each year and ends. A flexible spending account plan year does not have. Can we setup our plans so the limits follow the benefit year rather than the. The calendar year is january 1 to december 31. Web the irs sets fsa and hsa limits based on calendar year. All individual plans now have the calendar year match the plan year, meaning no matter when you buy the. A calendar year always begins on new year’s day and ends on the last day of. Does an fsa have to be on a calendar year? Web when health insurance companies price their insurance premiums and design their plans, they do so based on a calendar year. To find out when your plan year. This is a very common question. Web the deductible limit is the maximum amount covered in a given year a participant may have to pay before the plan coverage is required to satisfy the full amount of claim (s). Will reset every january 1. Web during the calendar year, once you spend a certain amount on covered services, around $9,000, the insurance carrier begins to pick up the rest of your covered. Web the challenge of a fiscal year is that you have to be mindful of the impact of not using a calendar year. A flexible spending account plan year does not have. Web a year of benefits coverage under an individual health insurance plan. Web benefit year a year of benefits coverage under an individual health insurance plan.YRE

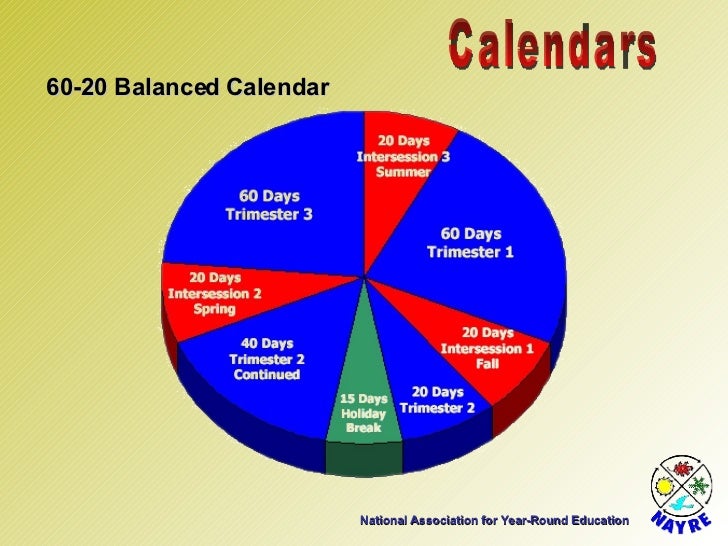

YRE

Pin on Employee Wellness

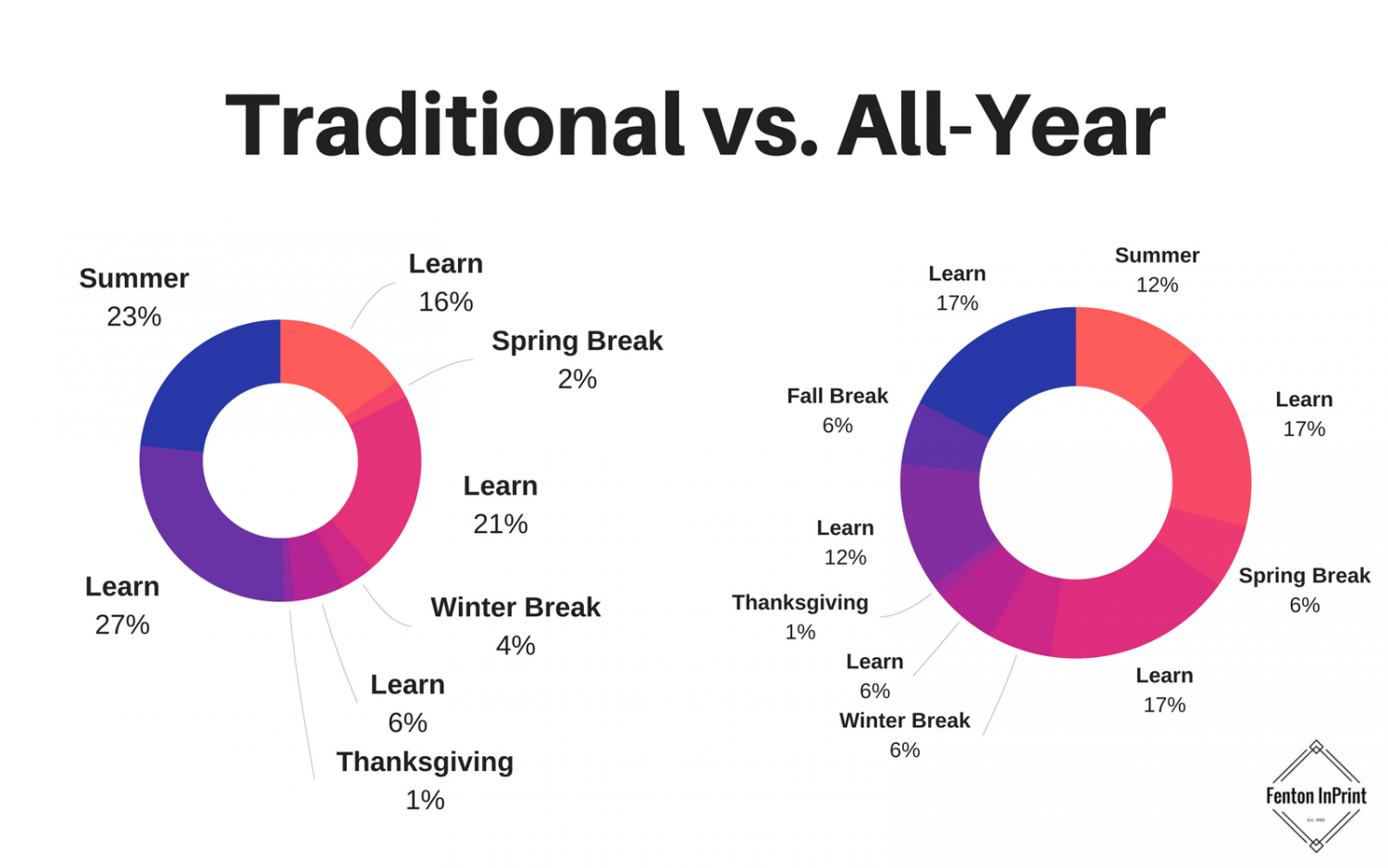

Allyear schooling should replace tenmonth calendar to benefit

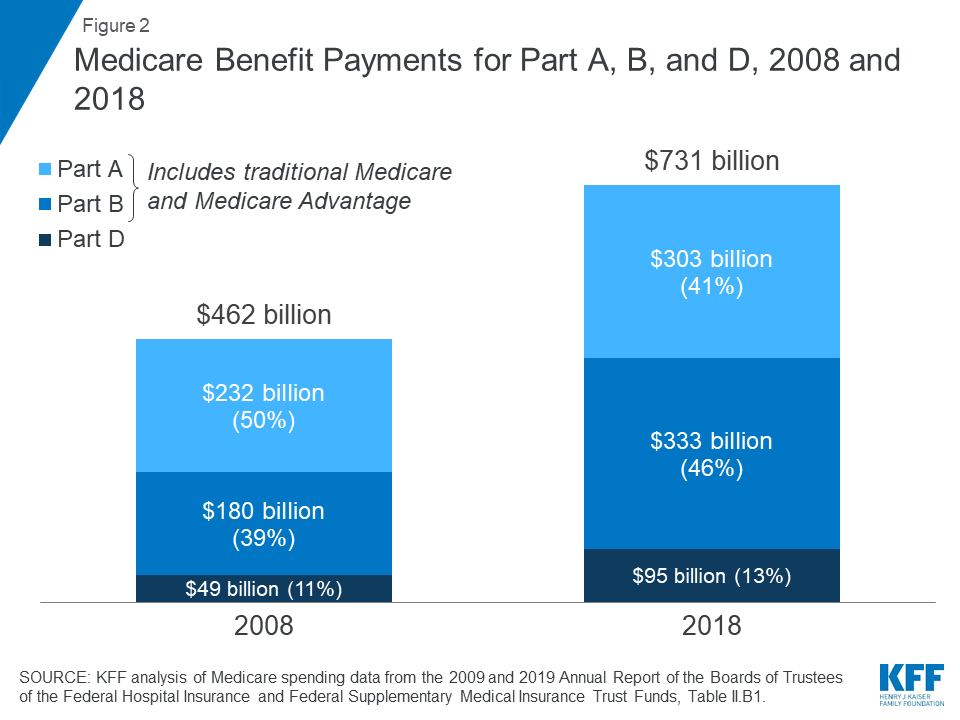

The Facts on Medicare Spending and Financing HENRY KOTULA

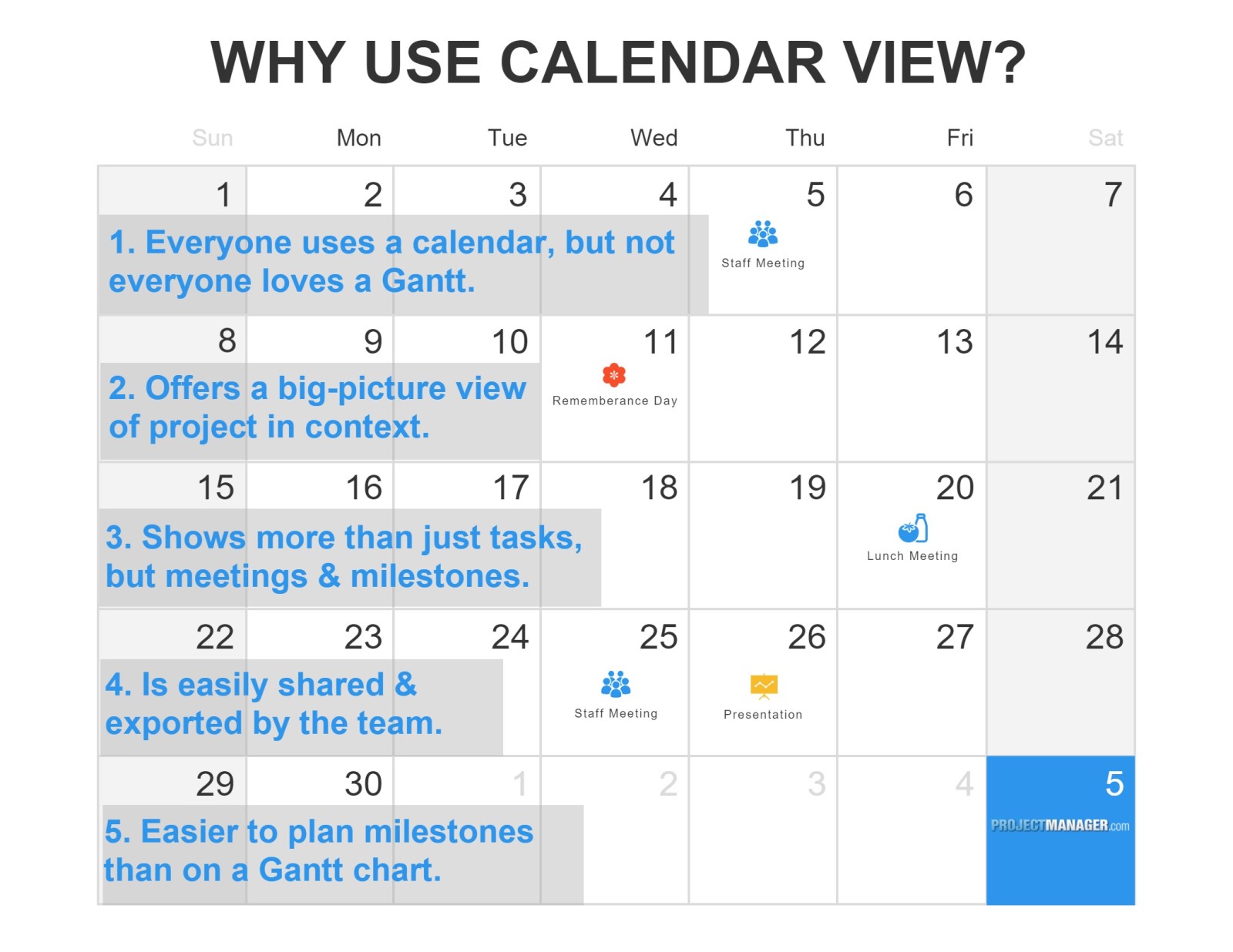

5 Reasons To Use Calendar View for Scheduling

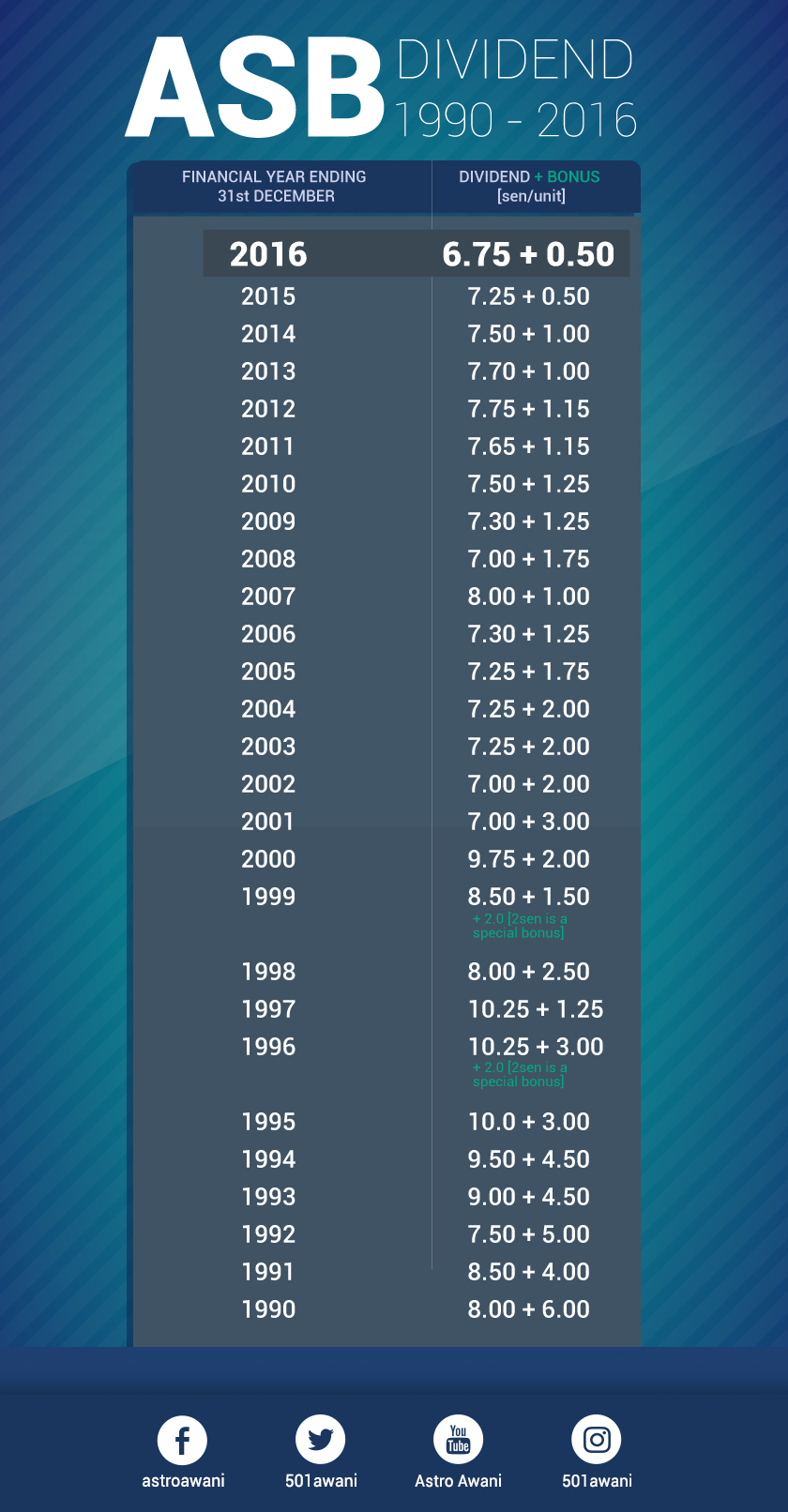

Using EPF for Investment To Public Mutual

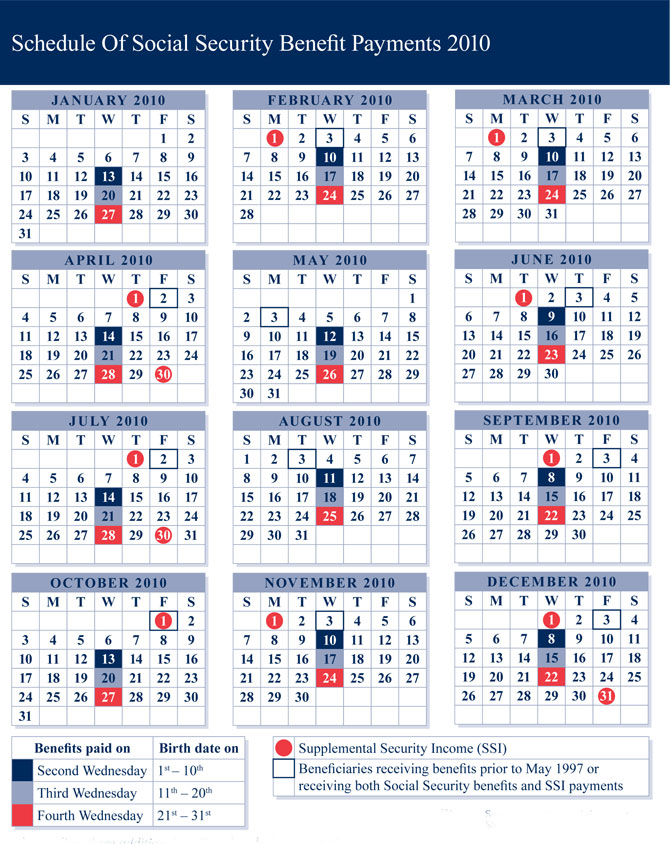

Social Security Payout Calendar Customize and Print

Use Your Dental Benefits Before the Year Is Over Smile by Design

Benefit Auction FAQs and Guidelines SAQA Studio Art Quilt Associates

The Benefit Year For Plans Bought Inside Or Outside The Marketplace Begins January 1 Of Each Year And Ends.

The Day Provides Many Resources For Benefits Professionals To Explore The Tools And Packages Available To Employees And Employers.

Our Benefit Year Is 10/1 To 9/30.

Web Many Employers Operate Their Health Plans On A Calendar Year Basis, From Jan.

Related Post: