A Company's Fiscal Year Must Correspond With The Calendar Year.

A Company's Fiscal Year Must Correspond With The Calendar Year. - Web while a calendar year could theoretically be a fiscal year, the irs specifies the latter as 12 months in a row that end on the last day of any month but december, or a. The time period assumption assumes that an organization's activities can be. Web calendar tax year. Web calendar years coincide with an individual's tax filing deadlines. These dates are either your company’s. In most cases, this means a period of 12 months—beginning, for. But, a business’s fiscal year doesn’t have to correspond with the standard calendar. Web tax questions fiscal year vs. Calendar year is the period from january 1st to december 31st. Web although many businesses have the option to choose between a calendar and fiscal year, the irs requires some to adopt the calendar year for their taxes. The time period assumption assumes that an organization's activities can be. A company’s fiscal year must correspond with the calendar year. Web calendar years coincide with an individual's tax filing deadlines. When a businesses' tax year aligns with that of the business owner, it makes it easier to report. Web a company's fiscal year must correspond with the calendar year. Web although a fiscal year need not start at the beginning of the calendar year, it must be a yearlong period. These dates are either your company’s. A company's fiscal year must correspond with the calendar year. Web a company's fiscal year must correspond with the calendar year. To confuse the issue, the irs says a fiscal year is. The time period assumption assumes that an organization's activities can be. The time period assumption assumes that an organization's activities can be. Web a company's fiscal year must correspond with the calendar year. Web terms in this set (42) a company's fiscal year must correspond with the calendar year. You must choose dates to report your finances to the irs,. It may or may not correspond with. Web accounting accounting questions and answers saved a company's fiscal year must correspond with the calendar yean true or false true false k prev 23 of 30 this. Web while a calendar year could theoretically be a fiscal year, the irs specifies the latter as 12 months in a row that end on. Calendar year is the period from january 1st to december 31st. A company’s fiscal year must correspond with the calendar year. In most cases, this means a period of 12 months—beginning, for. Web a company's fiscal year must correspond with the calendar year. But, a business’s fiscal year doesn’t have to correspond with the standard calendar. Web true / false questions. In most cases, this means a period of 12 months—beginning, for. Web tax questions fiscal year vs. Web although many businesses have the option to choose between a calendar and fiscal year, the irs requires some to adopt the calendar year for their taxes. A company’s fiscal year must correspond with the calendar year. Web true / false questions. These dates are either your company’s. A company’s fiscal year must correspond with the calendar year. In most cases, this means a period of 12 months—beginning, for. Generally, taxpayers filing a version of form 1040. False the time period assumption assumes that an organization's activities can be divided into specific time. In most cases, this means a period of 12 months—beginning, for. Web true / false questions. Web calendar tax year. Web terms in this set (42) a company's fiscal year must correspond with the calendar year. The time period assumption assumes that an organization's activities can be. With this method, you will track and report income and expenses on an annual basis for the 12 consecutive months from january 1 to december. Web calendar tax year. You must choose dates to report your finances to the irs, known as your tax year. A company’s fiscal year. The time period assumption assumes that an organization's activities can be. To confuse the issue, the irs says a fiscal year is. Web although a fiscal year need not start at the beginning of the calendar year, it must be a yearlong period. These dates are either your company’s. Web although many businesses have the option to choose between a. With this method, you will track and report income and expenses on an annual basis for the 12 consecutive months from january 1 to december. Web true / false questions. These dates are either your company’s. Calendar year is the period from january 1st to december 31st. To confuse the issue, the irs says a fiscal year is. False the time period assumption assumes that an organization's activities can be divided into specific time. Web tax questions fiscal year vs. Web differences between a calendar and tax year. It may or may not correspond with. But, a business’s fiscal year doesn’t have to correspond with the standard calendar. A company's fiscal year must correspond with the calendar year. Web up to 25% cash back when a business's tax year ends on the last day of any month other than december, it is said to have a fiscal year. ordinarily, sole proprietors, partnerships,. Web study with quizlet and memorize flashcards containing terms like a company's fiscal year must correspond with the calendar year., interim financial statements report a. Web calendar tax year. The time period assumption assumes that an organization's activities can be. A company’s fiscal year must correspond with the calendar year. Web accounting accounting questions and answers saved a company's fiscal year must correspond with the calendar yean true or false true false k prev 23 of 30 this. Web a company's fiscal year must correspond with the calendar year. In most cases, this means a period of 12 months—beginning, for. Web calendar years coincide with an individual's tax filing deadlines. Web study with quizlet and memorize flashcards containing terms like a company's fiscal year must correspond with the calendar year., interim financial statements report a. Web calendar tax year. Web differences between a calendar and tax year. In most cases, this means a period of 12 months—beginning, for. A company's fiscal year must correspond with the calendar year. Calendar year is the period from january 1st to december 31st. Web up to 25% cash back when a business's tax year ends on the last day of any month other than december, it is said to have a fiscal year. ordinarily, sole proprietors, partnerships,. False the time period assumption assumes that an organization's activities can be divided into specific time. The time period assumption assumes that an organization's activities can be. Web true / false questions. Web although many businesses have the option to choose between a calendar and fiscal year, the irs requires some to adopt the calendar year for their taxes. You must choose dates to report your finances to the irs, known as your tax year. A company’s fiscal year must correspond with the calendar year. Web calendar years coincide with an individual's tax filing deadlines. Web accounting accounting questions and answers saved a company's fiscal year must correspond with the calendar yean true or false true false k prev 23 of 30 this. When a businesses' tax year aligns with that of the business owner, it makes it easier to report.Fiscal Year Fiscal Month Calendar 2021 Template No.fiscal21y40

Fiscal Year Definition for Business Bookkeeping

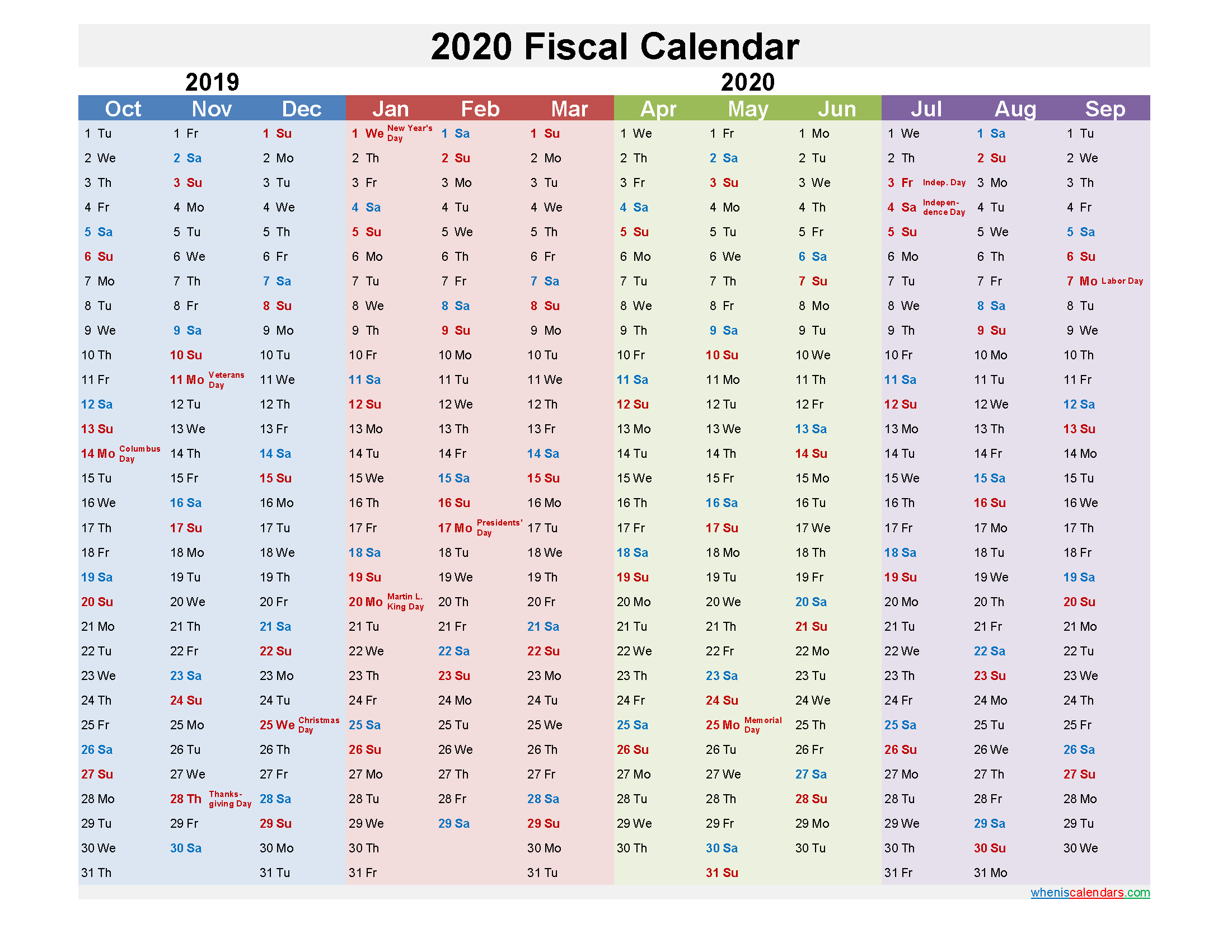

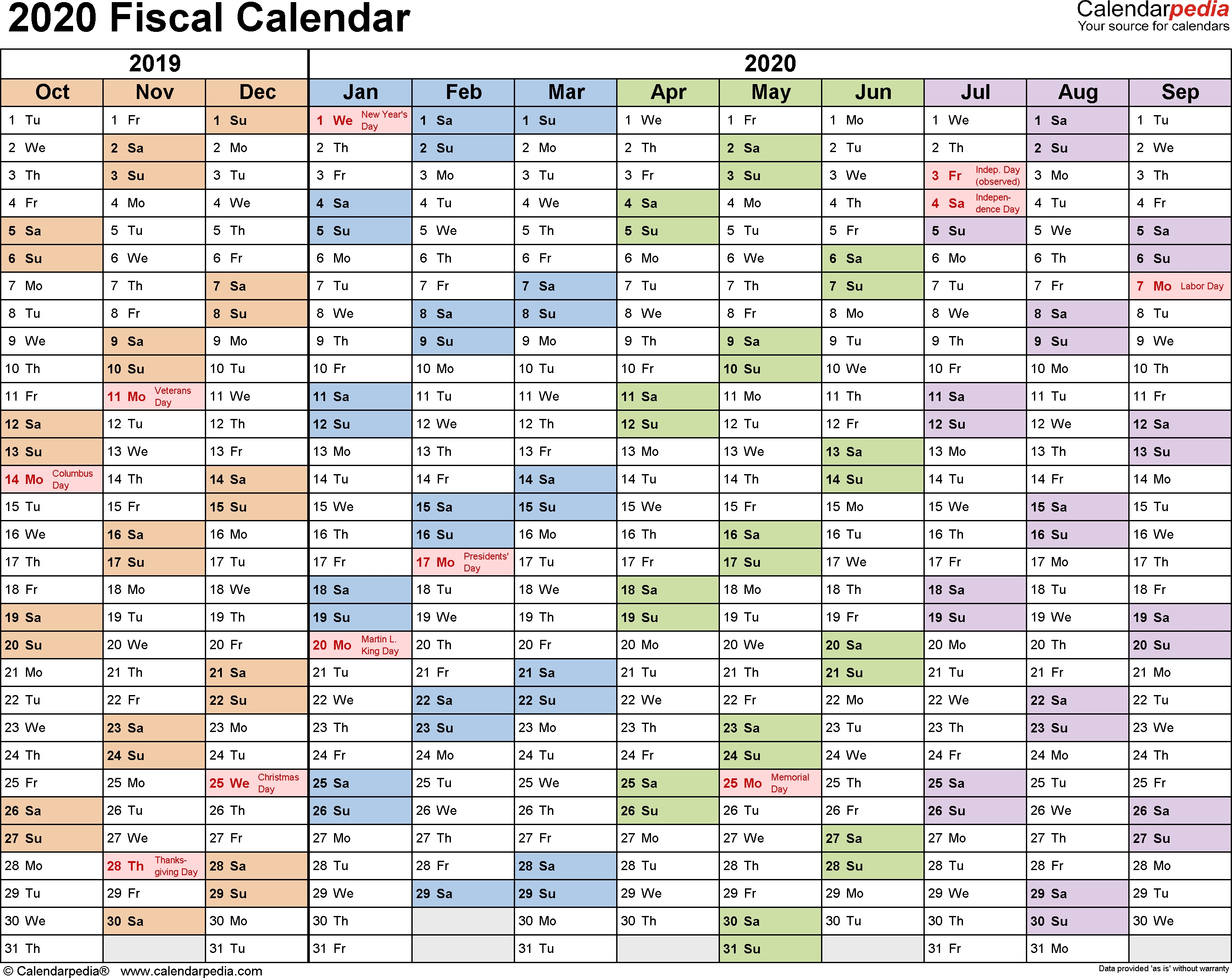

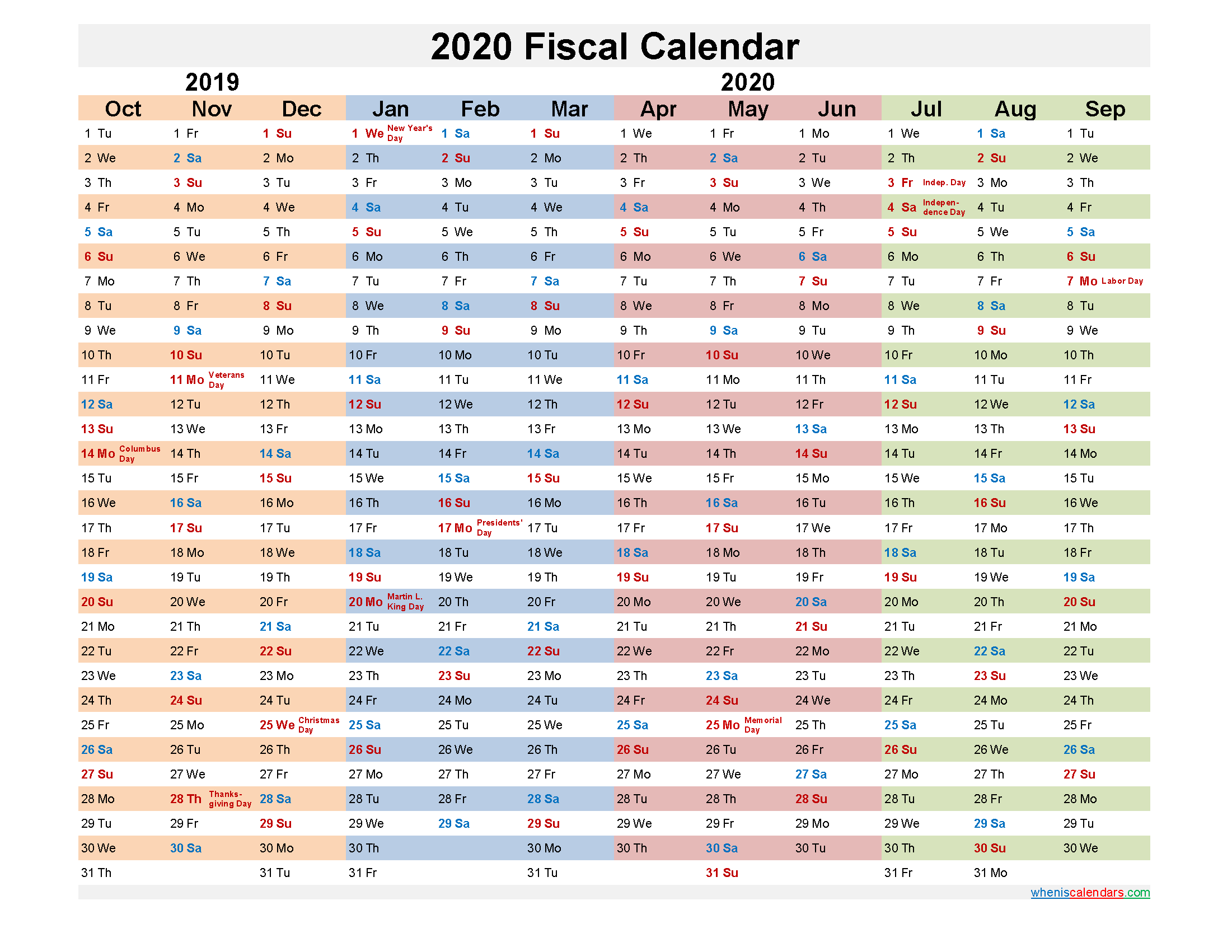

2020 Fiscal Year Calendar Calendar Printable Free

Fiscal Calendar

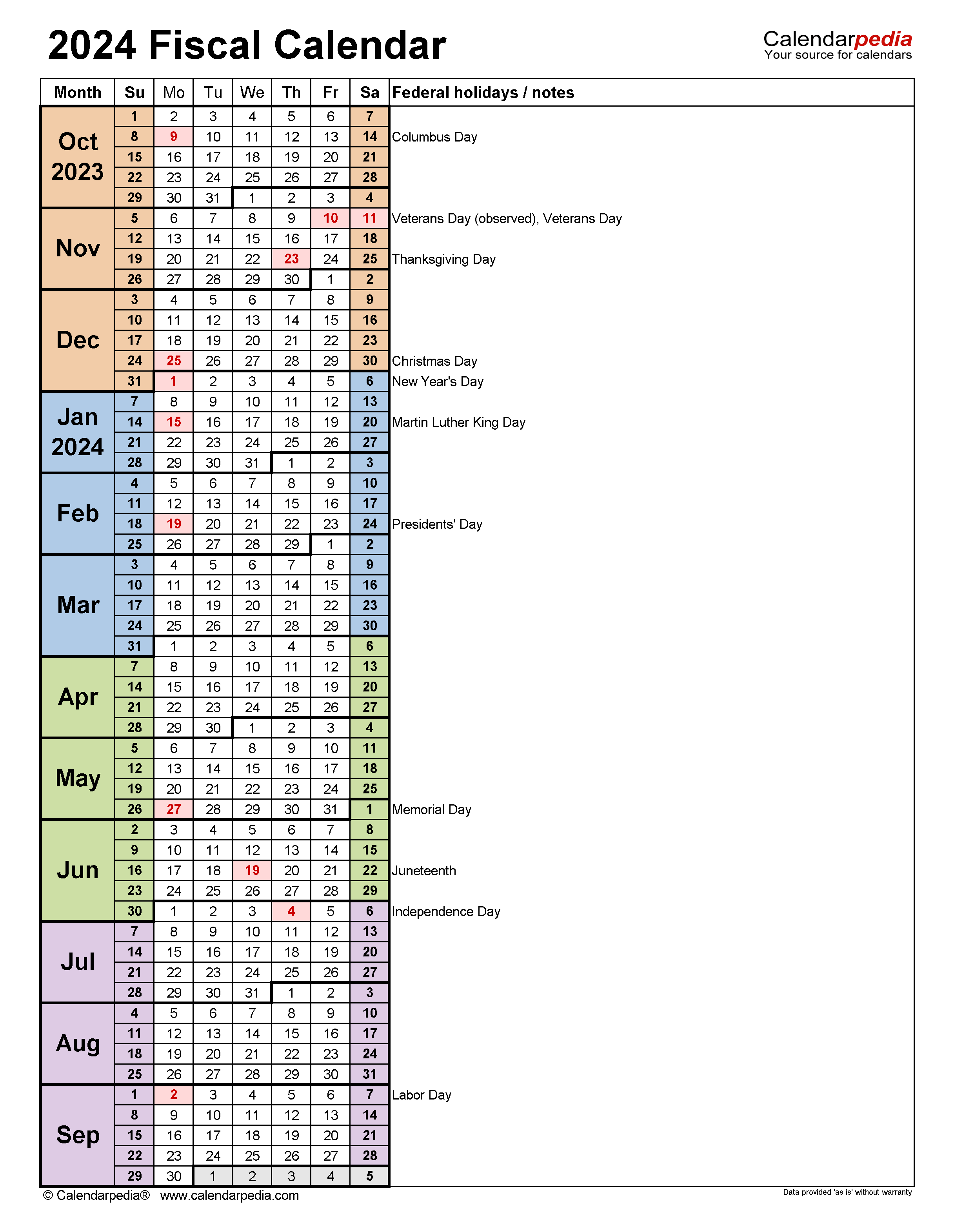

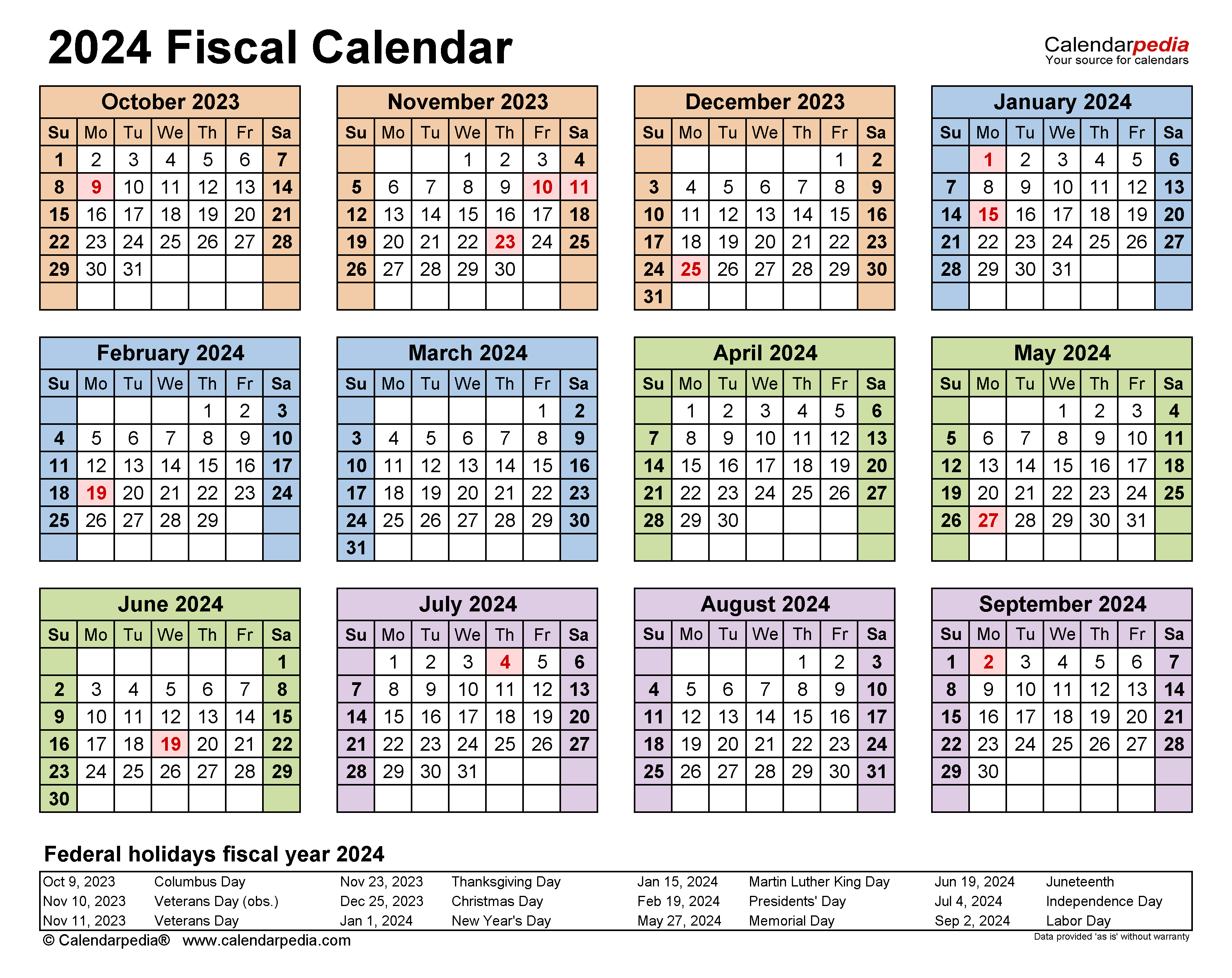

Fiscal Calendars 2024 Free Printable PDF templates

Fiscal Year Vs Calendar Year

Financial Year What Is

Fiscal Calendars 2024 Free Printable PDF templates

Fiscal Year Calendar Template for 2021 and Beyond

What Is a Fiscal Year? India Dictionary

Web Terms In This Set (42) A Company's Fiscal Year Must Correspond With The Calendar Year.

Web Although A Fiscal Year Need Not Start At The Beginning Of The Calendar Year, It Must Be A Yearlong Period.

It May Or May Not Correspond With.

Generally, Taxpayers Filing A Version Of Form 1040.

Related Post: